Global Inflation Data Stunts Bitcoin's Growth

Market Movers

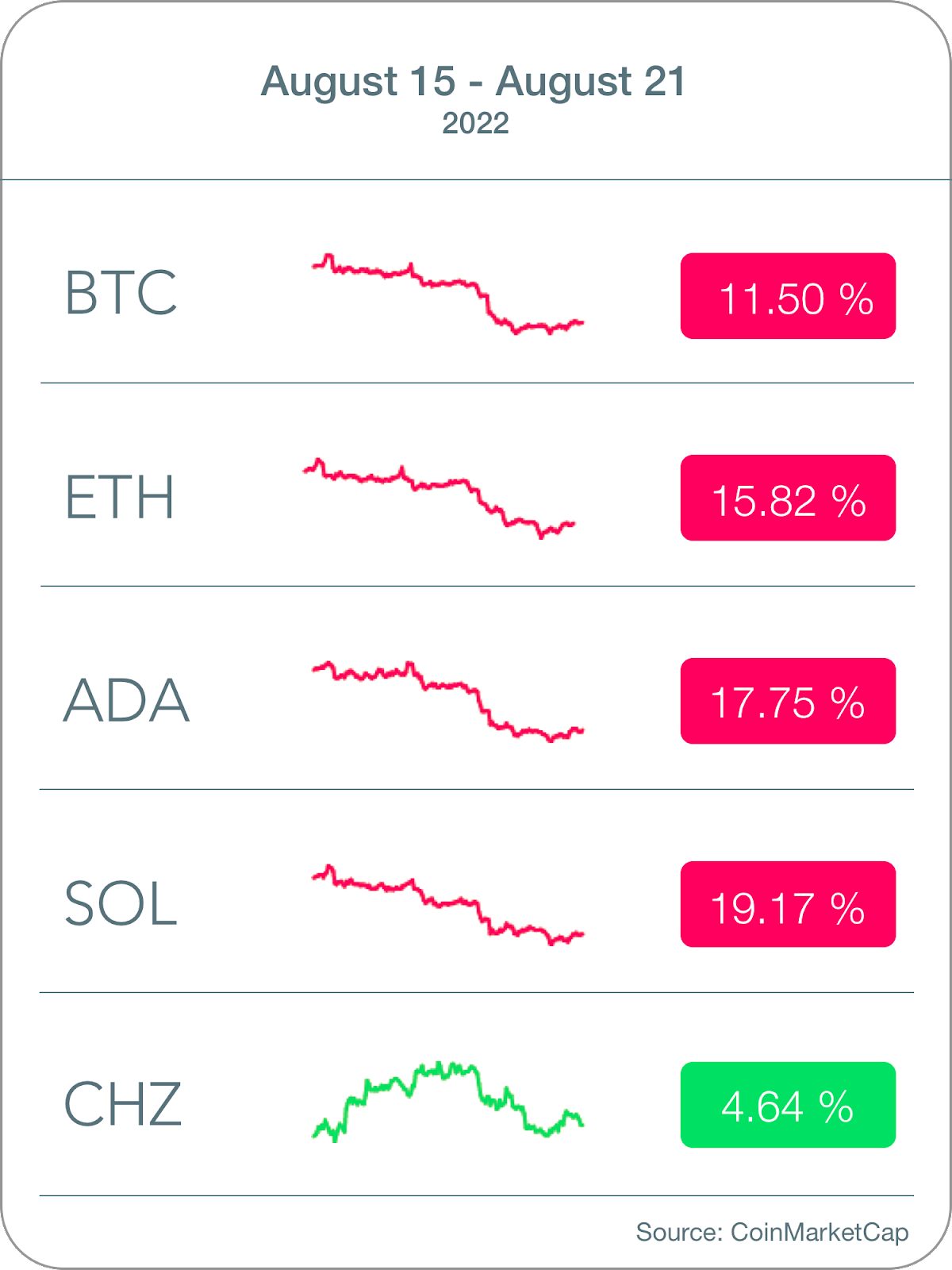

The largest coins by market cap were in the red for the week as the market retreated in response to German inflation data and Wednesday’s release of minutes from the Fed’s July meeting

Chiliz (CHZ), our pump coin of the week, rose 4.64% after one of its major issuers, Socios.com, received regulatory approval in Italy (via CoinDesk)

CHZ is the “world’s leading blockchain fintech provider for sports and entertainment” in which fans can buy tokens for their favorite sports teams to then to vote on team decisions and even receive rewards. Learn more here.

First Sip

TOTAL VALUE LOCKED INTRO

If you’re a frequent reader of this newsletter, you have a decent grasp of crypto fundamentals and common coins. Now, maybe, you’re thinking of investing or have invested and are looking into metrics to judge a project’s health. One common one is “total value locked” (TVL).

TVL measures the amount of crypto surrendered to a Decentralized Finance (DeFi) protocol through staking, lending, or a liquidity pool. It’s worth noting that this metric is highly volatile as it fluctuates not only based on the deposit/withdrawal of the locked asset but also with the locked asset’s value. The latter is because TVL is usually reported in a fiat currency like the U.S. Dollar and that fluctuates with the demand/supply changes of the cryptocurrency.

The following example is with Bitcoin but would work for any coin and locking scenario your protocol-of-interest supports. If you’re staking Bitcoin to your protocol of interest, the TVL will go up upon your deposit. If the price of Bitcoin decreases, then the TVL goes down even though the amount of BTC deposited hasn’t changed. This is even more pronounced with a chain’s native cryptocurrency, as they typically experience greater volatility as long as it’s not a stablecoin.

Instead of looking at TVL, look at the specific changes in the locked cryptocurrencies. While it’s not as neat or a summary metric for the health of a crypto protocol, this will give you a better grasp of the protocol’s actual health with more resistance to market turbulence. It’s not perfect, though, as typically, large price changes are also marked by changes in value locking.

Even with all of this, TVL, like most metrics, has succumbed to Goodhart’s Law: “when a measure becomes a target, it ceases to be a good measure” (via Wikipedia). Protocols have often offered and continue to offer large rewards for locking value in their protocol—think Celsius Network. As always, do your due diligence before investing and be wary.

“Lies, damned lies, and statistics.”

Table Talk

GLOBAL INFLATION STUNTS BITCOIN’S GROWTH

Bitcoin ended Friday by dropping 8.4%, its largest single-day decline since June 8th (via CoinDesk).

The cryptocurrency began to plunge Friday morning after the release of Germany’s producer prices number for July, the country’s leading indicator for inflation, which rose to a yearly high of 37% (via Trading Economics). The jump marks Germany’s largest one-year rise in the metric since 1949.

Traditional markets dipped, to a lesser extent, on Friday as well, with the Dow Jones Industrial Average falling 0.8% and the S&P 500 and Nasdaq declining 2.1% and 1.3%.

Minutes from the Federal Reserve’s July meeting released on Wednesday revealed that policymakers continue to be concerned about inflation and may not slow the rate of rate hikes anytime soon, which also contributed to the wiping away of last week’s crypto price pump after consumers’ sentiments turned bearish following July’s CPI number of 8.5% (via Federal Reserve).

NFT Buzz

POPULAR ETHEREUM NFT COLLECTIONS FACING LIQUIDATION EVENT

In a January newsletter, we reported that crypto lenders had begun accepting NFTs as loan collateral. This event was touted as a hallmark of the utility of NFTs and how they hold real value. Now, this might come back to bite the ecosystem as owners of popular NFT collections like Bored Ape Yacht Club (BAYC) and CryptoPunks have given their NFTs as collateral and are in a margin call situation (via CoinTelegraph).

BendDAO is one such protocol that offers ETH loans at 30-40% of a collection’s floor price at the time of the loan (via BendDAO). BendDAO triggers margin calls when the floor price of an NFT collection falls below a “health factor,” which is a combination of the floor price, debt with interest, and a liquidation threshold (via BendDAO). Due to steep decreases in bluechip collection prices, debts are now being called (via CoinTelegraph). Now, as lendees default on their loans, BendDAO will have to liquidate the NFTs to pay lenders to the protocol. This could trigger a cascade in some NFT collection values.

The first NFT liquidation from BendDAO was triggered earlier this week (via CoinTelegraph). Buy the dip?

DeFi Demographic

DOGE…CHAIN?

The value of DogeCoin (DOGE) rose steeply this week due to a totally unrelated project with a related name that’s touting itself as DogeCoin’s Layer-2 (L2), DogeChain. DogeChain is not even built on DogeCoin, but is instead an EVM comparable chain built on Polygon Edge (via Decrypt). The closest arguable link to DogeCoin is that it accepts DOGE and lets you convert it to wDOGE such that it is ERC-20 compatible and able to be used on DogeChain. Additionally, they’ve also planned airdrops for current DogeCoin holders (via Decrypt).

DogeCoin’s founders have already distanced themselves from DogeChain by making it clear they’re not involved (via Twitter). Still DogeChain has already seen some success with over $20M+ transacted on the chain and 50K+ wallets created for it (via Decrypt).

Blatant theft aside, this is a fairly ingenious hijacking of a meme coin. Individuals have criticized DogeCoin of having no real value or utility, which the project’s creator has even admitted to (via CNN). Still, the coin has a large following and has garnered the attention of Elon Musk. Building a chain that adds utility to the meme coin, while giving owners of the meme coin a free way to start using the protocol seems like a way to short circuit adoption. We’ll be watching the DogeChain model closely—don’t be surprised if you see it replicated. Heard something about Shibarium… (via Decrypt).

Final Cup

Global inflation concerns and bearish Fed meeting notes caused Bitcoin and nearly all cryptocurrencies to tumble for the week. Risk assets continue to feel the effects of inflation.

BAYC and other blue-chip NFT collections that have been used as collateral for crypto loans may be in trouble this week as margin call situations have triggered a growing number of liquidation events. A buy the dip opportunity?

DogeChain—a totally separate project from DogeCoin—has caused DogeCoin price to catapult as it offers an L2 solution for DogeCoin built on Polygon. Don’t be surprised if you see more of this in the future, especially for meme coins.

Meme of the Week (via Twitter).

The “Merge” is coming, iykyk.

Pat + Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing. All of the opinions expressed here are our own unless cited otherwise.