Crypto’s Attack on the U.S. Dollar

Biden Administration in fear of losing global reserve currency status

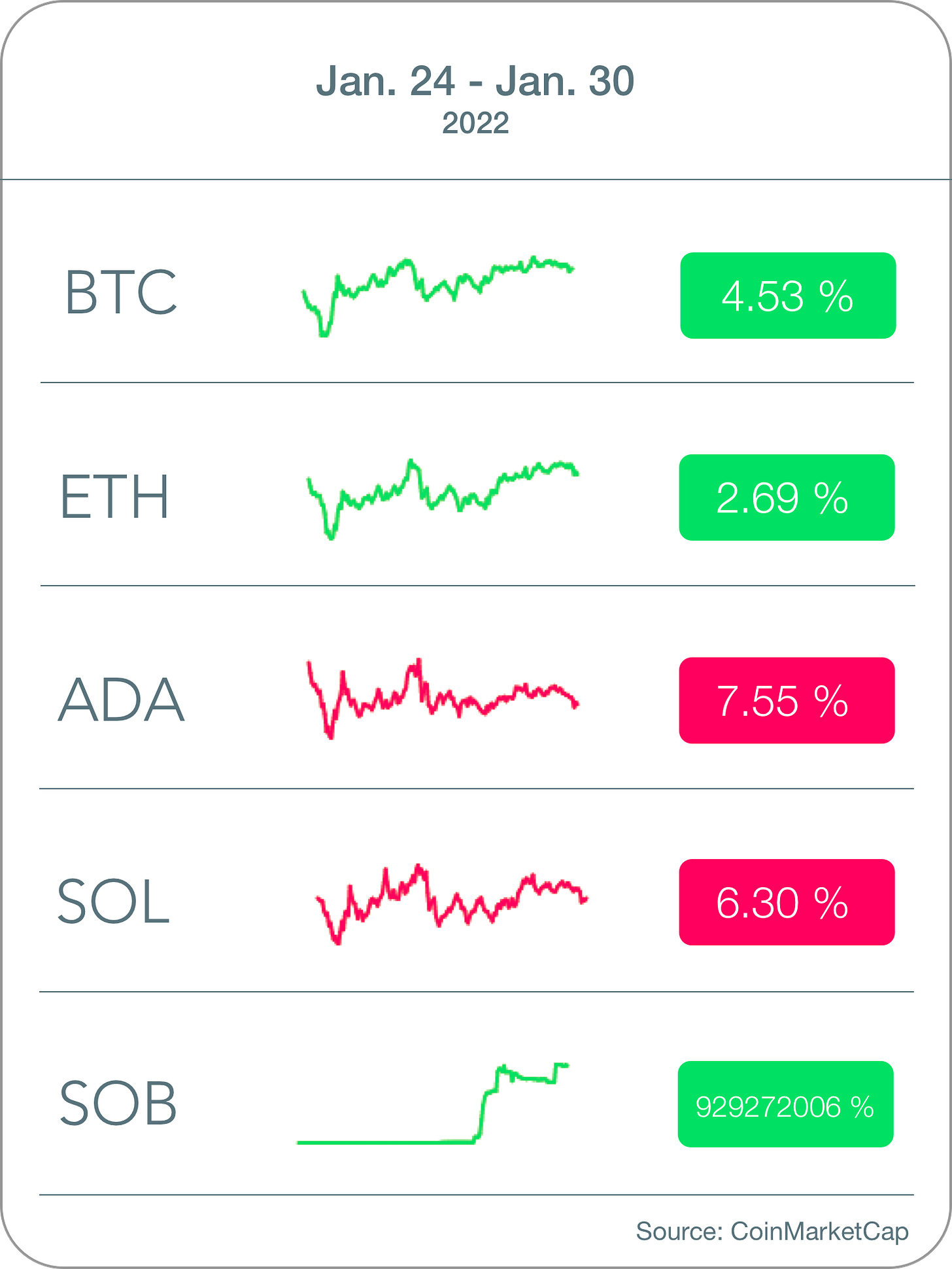

Market Movers

The two largest coins by market cap rallied this past week despite White House Announcements/Fed decisions. Altcoins did not fare as well, with Cardano and Solana headlining a down week for the group.

The highest 7 day gain for any coin on the market was Son of Babydoge (SOB)

SOB is supposedly Babydoge’s favorite son and the grandson of Doge (Dogecoin). Lots of Doges.

The coin’s website promises some future utilities such as staking, a gamepad, and even an NFT marketplace (via SOBnet).

However, the project’s creators are anonymous, and all of the reviews of the coin say that it is a scam. Although it strategically doesn’t state this on the coin’s website, buyers of SOB say that the number of SOBs in their wallets fluctuates up and down, making it a rebase coin. Moreover, even if the price shoots up like it did this week, the number of tokens in your wallet decreases to your initial investment (via knowledgegapexpert). We love Doges, but one must perform adequate due diligence before investing in a project like SonofBabyDoge. It is also worth noting that their Twitter is suspended as we write this.

The biggest pump this week and the previous week have both been fraudulent. In the coming weeks, we’ll be writing about the highest-rising coins that are legitimate. It’s disappointing, but this is the frontier of finance.

Table Talk

It was an eventful week in the crypto world; here are two things you should know

BIDEN ADMINISTRATION TO SUPPOSEDLY REGULATE BITCOIN

Barron's reported Thursday that the Biden Administration is preparing to release an executive action in the next couple of weeks that will task Federal Agencies to regulate Bitcoin, cryptocurrencies, and other digital assets like NFTs. Although the mainstream media is primarily portraying the report as overwhelmingly negative due to their lack of knowledge on the subject and/or optimization for clicks above all else. Here are a few clarifying points:

Bitcoin was designated a “matter of national security” as “digital assets don’t stay in one country, it’s necessary to work with other countries on synchronization” (via Forbes). This guidance does not suggest a nuclear action from the Biden administration.

Why does the Biden administration care, though? Other than the premise of Bitcoin (and broader cryptocurrency) as a mechanism to disassociate monetary policy from the government, the decentralization of Bitcoin makes it a threat to the U.S. Dollar’s status as the world’s reserve currency which is a significant foregin policy lever for the U.S. This also explains the Russian government’s “support for proposals that would promote taxed and regulated crypto mining in the country” as an Active Measure—political warfare that primarily relies on non-traditional pressure to destabilize a government—against the U.S. (via Forbes).

It is unlikely and highly improbable that the White House figures out a way to even execute a nuclear option like completely regulating crypto. Bitcoin and other cryptocurrencies are insulated from such action by having border-agnostic nodes. Initial reports hint that regulations will probably revolve around fixing taxing issues, investigating Bitcoins’ impact on the U.S. dollar, and reducing criminal activity in the space (via Forbes). There have also been suggestions that improvements in these areas will only make public sentiment more bullish towards Bitcoin and cryptocurrencies going forward. Regulation of BTC is inevitable; it’s just a natural step in its adoption. Take a sip of your whiskey neat and stop freaking out.

THE FED AVOIDS MAJOR DECISIONS

In their much anticipated January 26th meeting, the Fed announced…

They will not be raising the federal funding rate. Again.

That they will, but do not know when/how, they will be reducing their balance sheet.

That fiscal policies may be reviewed to combat inflation.

Although rates will inevitably be hiked at some point in the near future, Chairman Powell did not reveal any exact time frame in his Wednesday announcement. In spite of the ambiguity surrounding the situation, Powell’s guidance during the Media Q&A suggests some sort of rate increase in March, saying: “the committee is of a mind to raise the federal funds rate at the March meeting, assuming that the conditions are appropriate for doing so” (via NYT). Balance sheet activity and fiscal policy actions should be two things to keep an eye on over the next couple weeks/months.

In summary, the Fed did not reveal much direction during their meeting. Because of this, most Bitcoin/cryptocurrencies sold off on late Wednesday/early Thursday before rallying back for the rest of the week.

NFT Buzz

DYDX JOINS NFT SPACE

The decentralized exchange dYdX will be releasing 4,200 “Hedgies” NFTs in two stages 2,443 in an initial mint distribution governance votes, traders, and the general public in stages for gas cost only (via dYdX). Then, the remaining 1,757 will be distributed as prizes in dYdX’s trading leagues (via dYdX).

Last week, we talked about large corporations getting NFT FOMO, but it seems even established crypto protocols are getting in on the action as a way to build their brand and community. Hedgies will reward early-adopters of dYdX and incentivize traders to become part of this exclusive group by winning their trading league—thereby incentivizing use of the protocol.

GENESIS ACCEPTS NFTS AS COLLATERAL

Genesis, which ships itself as “the biggest trading desk for professional investors in cryptocurrency markets,” has started accepting NFTs as leverage collateral (via FT). This acceptance paves the way for the potential of Genesis offering NFT derivatives to its institutional investors. With this, NFTs are further cemented as a legitimate asset class as they can now provide the same collateral benefits as traditional, physical art. Bullish.

DeFi Demographic

Popular entrepreneur Anthony Pompliano had an interesting take in his recent YouTube Video as to why he suspects Bitcoin receives so much backlash.

Pompliano compares the inception of the internet to where we are today with Bitcoin. Bitcoin, like the internet, has some inherent flaws (e.g.like criminal activity) that are unavoidable. However, the long-lasting benefits that the technology will provide to society result in a net positive.

Additionally, anytime something as revolutionary as Bitcoin is introduced that challenges foundational institutions/ideas, such as the U.S. Dollar, skeptics, and cynics of the new technology are inevitable.

He ended the video with some hard-hitting questions:

Will the U.S. sit out and let both their allies and enemies benefit from Bitcoin and other cryptocurrencies? Or, will the U.S. push forward and become the global leader in the space?

Are we pro-authoritarianism or pro- innovation/freedom of speech?

We’ll be seeing the Biden administration's answer to this one in the coming weeks.

Tweet of the Week

Our tweet of the week comes from @zhusu.

Well put Zhu. We got some reality shaping to do.

Final Cup

Although the report of Biden/White House’s plans for digital asset regulation received a mostly negative reception from the media, one needs to take a breath and look at all of the facts and come to their own conclusion. Some form of regulation is inevitable. Bitcoin was in the green for the week. Keep passively allocating. We are too powerful to fail.

The Fed did it again. We’ll be back in March.

Widespread NFT adoption is heating up with new collections from established crypto protocols and they are even being used as collateral. Let’s see who joins the party next week.

Lots of good questions from Pompliano. Tweet at us your answers @cpong2021 or comment on Substack. All feedback/viewpoints are appreciated.

Meme of the Week

We still think the GOAT has some fuel left in the tank.

Pat + Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing.