The Weekly Roundup: Mining Dominates Bitcoin Conference, the CryptoPongz NFT, Strike Takes on Credit Cards

Market Movers

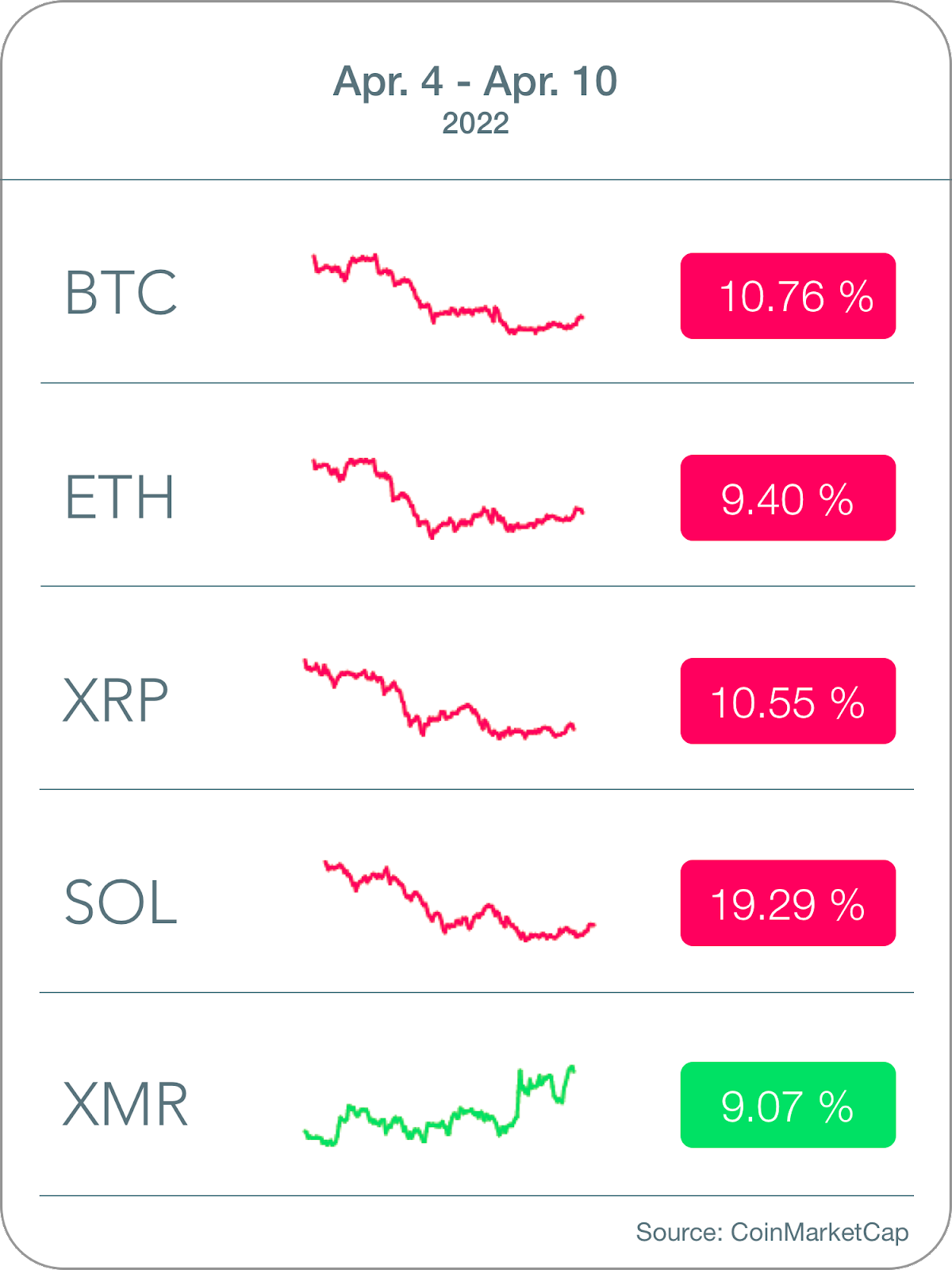

The majority of the largest coins by market cap saw down weeks. An analysis from CoinTelegraph suggested that if the BTC price fell under $44K, which it already has, it could continue to fall to $37K. Regardless, do your own research and do not fret when volatility arises. Diamond hands

Moner (XRM) was our biggest mover of the week, rising a little over nine percent

XMR, founded in 2014, uses advanced cryptography to allow its users to exchange its coin privately and securely—taking crypto transactions from pseudonymous to anonymous

A coin that allows anonymous crypto transactions pumping the same week as the largest Bitcoin conference? Probably nothing

First Sip

If you’re already a crypto native, feel free to skip to “Table Talk.”

THE ETHEREUM “MERGE” AND PROOF OF STAKE

Three weeks ago, we speculated that Proof of Work (PoW) regulatory pressures might help push the Ethereum network to finally implement Proof of Stake (PoS) as they have been promising since the whitepaper. While this was likely not the primary contributing factor, Ethereum announced that they would, finally, be executing the “merge” to PoS before June 30th this year (via Ethereum Foundation).

It’s referred to as the “merge” because a small separate network called the Beacon Chain was created to develop and test the new PoS network. The “merge” will combine this network with the current nodes on the main Ethereum network and convert them to PoS consensus.

A QUICK REVIEW

As we’ve mentioned in previous weeks, the Ethereum network currently implements the same consensus mechanism as Bitcoin called PoW. PoW is harmful to the environment as it uses raw computational force to maintain the network’s security and validity. The algorithm works by having “miners” that compute guesses to find a valid solution to an equation for each transaction.

HOW IS PoS DIFFERENT?

PoS changes the game. Instead of using “miners” ETH owners must “stake” their coin to become validators in the network. It takes 32 ETH To become a “validator,” where that ETH can then be used to run the validation code. The validator used for a transaction or to create another ETH block is chosen at random. There is no competition, like in PoW, which makes it much more energy-efficient.

This system does leave the Ethereum network vulnerable to the “51% attack,” where if one entity controlled 51% or more of the staked ETH, it could then validate malicious blocks—essentially print money. While this is highly unlikely, as approximately 193M unique wallets currently hold ETH, it remains a potential hazard for smaller networks looking to implement PoS (via YCharts).

If the Ethereum network successfully completes the merge this quarter, it will eliminate the greatest barrier to widespread ETH adoption for all use cases—the high gas fees. Bullish.

Table Talk

MINERS DOMINATE BITCOIN CONFERENCE

Last week, we spoke about Bitcoin 2022, the largest Bitcoin conference that took place from April 6th to 9th in Miami, Florida. This week, we’re recapping some of the event’s hottest storylines.

Other than PayPal co-founder Peter Thiel calling Warren Buffet a “sociopathic grandpa from Omaha” (yes, he did say that), mining took up much of the table talk from the event (via CNBC).

Mining-specific companies took up about half of the exhibition space at the show—a steep increase from years past (via CoinDesk). Mining is currently the foundation of the two largest cryptocurrencies by market cap, Bitcoin and Ethereum, so its explosion is not surprising.

Certain mining-specific deals were announced during the event, headlined by Applied Blockchain, a company that constructs data centers that host bitcoin mining transactions, filing for an IPO (via CoinDesk). Additionally, Core Scientific, a Texas-based mining company, announced that it is looking to combat new mining regulations in its native state by moving some of its operations to the Middle East (via Bloomberg).

Forget government regulation when it comes to trading cryptocurrencies; mining regulation will likely be a whole new beast.

Speaking of beasts, pictured below is the Bitcoin Bull, a play on Wall Street’s Charging Bull, that was revealed on the first day of the conference (via Marca). The financial future is here.

NFT Buzz

ANNOUNCING THE CRYPTOPONGZ

We’ll keep this short. Earlier this week, we announced the launch of our newest NFT collection—the CrytpoPongz.

You can find more information about the collection on our website, or on Twitter. Join the discord and retweet our announcement to take advantage of the white list opportunity.

Together we will rise.

DeFi Demographic

STRIKE TAKES ON THE CREDIT CARD CARTEL

At the Bitcoin Conference in Miami, Jack Maller, Founder of Strike, announced a peer-to-peer payment system built on the Bitcoin Lightning Network that essentially circumvents the MasterCard/Visa/Discover/AmericanExpress payment system (via YouTube).

Through partnerships with Blackhawk Network, the NCR Corporation, and Shopify, Strike enables currency-agnostic payments at stores like McDonald’s and Whole Foods. No matter what currency you want to use, you simply connect your wallet to the Strike system using a custom QR code, and then the transaction is instantaneously processed by using the BTC Lightning network as the intermediary. You can use fiat currencies or supported cryptocurrencies through this system.

Through this, merchants receive the entire payment from the user minus the BTC Lightning transaction fee instead of being subject to the fees from the purchaser’s bank, their bank, and the credit card provider. The implications of this at scale are incredible and threaten an industry and system that have been in place since 1966 (via YouTube). This is the power of web3—your move credit card providers.

Final Cup

Reports from Bitcoin 2022 indicated that mining dominated the event. Let’s see what crypto sub-sector takes the horns in 2023.

The CrytpoPongz are here. Check them out on our website or on Twitter. Our first whitelist opportunity has been posted. Mint date TBA.

Strike has created a credit card alternative on the BTC Lightning network to disrupt the credit card industry. We’ll be watching to see if this cannibalizes one of the most-entrenched infrastructural monopolies.

Meme of the Week (via Reddit)

Good boy, Billy. Good boy.

Pat + Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing.

If you were forwarded this newsletter, subscribe now below.