The Weekly Roundup: Binance Denies Russia Link, Coinbase to Launch NFT Marketplace, and $182M Beanstalk Hack

Market Movers

The majority of the largest coins were in the red for the week. Bitcoin (BTC) rose to as high as $42K on Thursday before retreating to its more bearish $40K range for the rest of the week. As usual, Ethereum (ETH) generally followed the BTC price movement

Ripple (XRP) erased its gains from the previous week and returned to following the trajectory of the other “blue[r] chip” coins

Kava (KAVA) was our biggest mover of the week, rising just south of twenty percent

KAVA is a layer-1 (L1) blockchain that combines the advantages of both the Ethereum and Cosmos blockchains to create a single, scalable KAVA network (via Kava)

First Sip

If you’re already a crypto native, feel free to skip to “Table Talk.”

LAYER 1 (L1) VS LAYER 2 (L2)

In the “Market Mover’s” section, we described KAVA as an L1 blockchain. What does that mean, and what is the difference between L1 and L2?

L1 is simply a blockchain, and examples of popular L1s include Bitcoin, Ethereum, and Solana. L2s are protocols built on those L1 blockchains that give some scaling improvement. Popular L2 protocols include Bitcoin Lightning, Polygon, and Arbitrum. We’ve talked about the high Ethereum gas costs due to their use of the Proof of Work (PoW) algorithm.

The idea behind L2s is that they distribute some of the load off the main L1 blockchain. This is why most L2 protocols exist on Ethereum and Bitcoin, not low transaction cost chains like Solana. The aim is to both decrease the monetary cost and time cost of the transaction by minimizing or eliminating the gas fee, which goes hand in hand with speeding up consensus.

Three different kinds of L2s exist nested blockchains, state channels, and sidechains. Nested blockchains are blockchains built atop L1 blockchains that have distinct properties to the L1 that allow for the cost decreases, and transactions are not sent back to the L2. State channels, on the other hand, use consensus mechanisms apart from the L1 network nodes and then publish the final state of a series of transactions to the blockchain. Finally, sidechains are similar to state channels, except they implement the less costly consensus mechanisms and record all the transactions in a public ledger and then send that information back to the L1 chain.

Table Talk

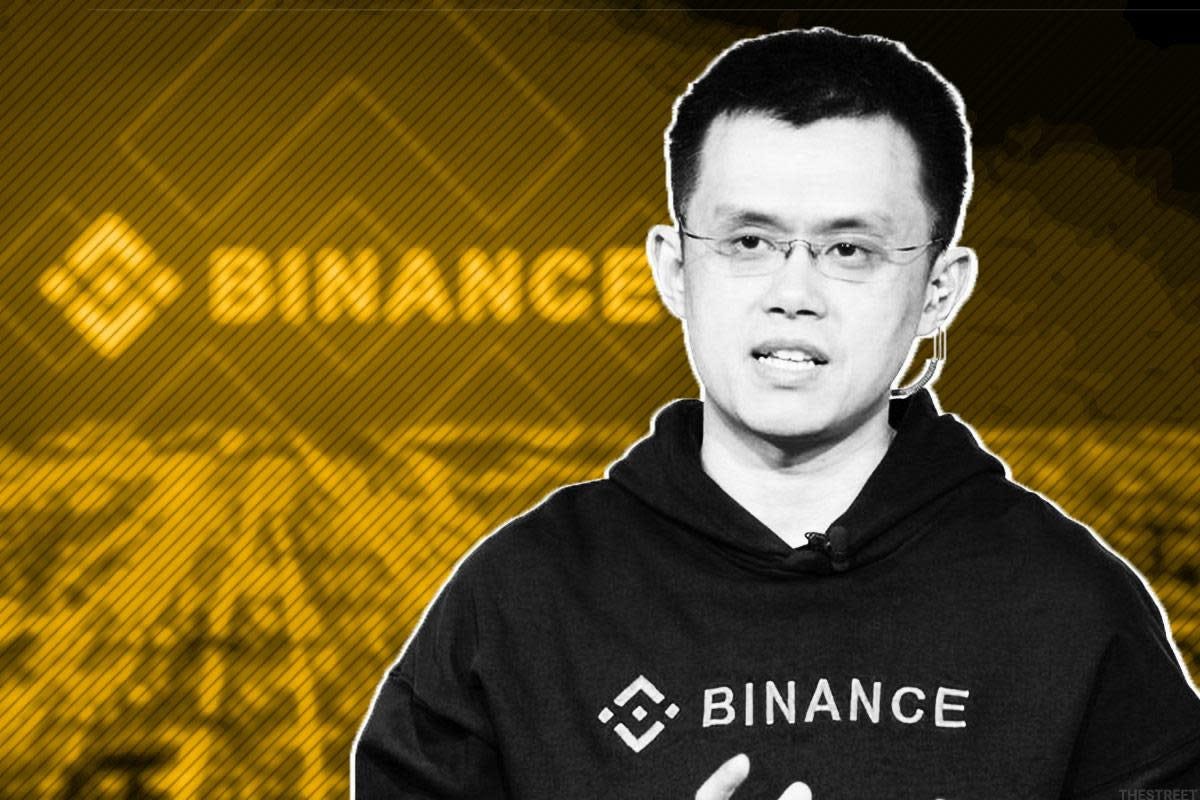

BINANCE DENIES TIES TO RUSSIAN AGENCY

This past Friday, Reuters reported that world-leading crypto exchange Binance released information to Russian financial intelligence agency Rosfin. Rosfin then allegedly used their newfound data to try and trace money sent to jailed Russian leader Alexei Navalny.

Binance founder/CEO Changpeng Zhao

Navalny and his camp have been transparent in their support for Binance since his arrest in January 2021. Navalny’s anti-corruption foundation has publicly encouraged supporters to donate using the platform due to the relative anonymity of blockchain-based donations. However, due to recent evidence, as Navalny's Chief of Staff, Leonid Volkov, told Reuters, these same donors who once thought their payments were untraceable could be in danger if Binance handed their know your customer (KYC) information over to Putin and his government.

The article contends that Binance's head of Eastern Europe and Russia, Gleb Kostarev, consented to Rosfin's request to share client data and in large part because he didn't have much choice in the matter. Neither Kostarev nor Zhao commented on the situation when contacted by Reuters.

On Saturday, Binance denied the claim stating, “Suggestions that Binance shared any user data, including Alexei Navalny, with Russian FSB controlled agencies and Russian regulators are categorically false” (via Binance).

NFT Buzz

COINBASE PREPARES NFT MARKETPLACE

Six months ago, Coinbase, the largest crypto exchange in the U.S. by volume, announced it would be implementing an NFT marketplace into its already-booming platform (via TechCrunch).

Exact details of the operation were kept behind closed doors until this past Wednesday, when the company’s Vice President, Sanchan Saxena, announced in a detailed Twitter thread that the marketplace would be available to people over the age of 18 in the coming weeks following the completion of its beta testing.

Coinbase aims to differentiate itself from other NFT marketplaces by establishing a one-stop Web-3 social lounge where users can show off the NFTs that they already own and/or are selling on their individual profiles. Similar to Instagram, people will be able to like, comment, and follow other users to keep themselves up to date with their peers’ latest NFT maneuvers.

Rather than cycling between Discord and Twitter, the two spaces that currently dominate the NFT social world, Coinbase aims to unite NFT customers under their singular ecosystem.

Saxena also noted that the marketplace would be free of transaction fees, at least at first, before introducing low single-digit fees at a later-announced time.

DeFi Demographic

HACKER TAKES $182M FROM BEANSTALK PROTOCOL

Crypto assets are very volatile. From a market perspective, this volatility can be interpreted as a measure of the underlying risk of an asset. With 37 hacks in the 38 weeks of 2022, pjc50’s comment on HackerNews is a good reminder for us all: “every DAO is a self-administering bug bounty for all of the value under its control” (via WSJ, HackerNews). The Lindy Effect, while simple, is a good rule of thumb for allocating your crypto capital. It states: “the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age” (via ModelThinkers). In other words, if something has been around for a while, it’s more likely to stay around.

This week’s hack featured Beanstalk Farms, whose own governance protocol was leveraged to orchestrate the hack. The Beanstalk protocol operated as a DAO to decide what decisions the protocol made. By staking stablecoins or other crypto assets to the protocol, the users were rewarded with their token BEAN, which corresponded to a vote in their DAO.

In this case, the hacker used another crypto-native service called a flash loan—essentially a very short-term loan—for $1B worth of stablecoins. The hacker then staked that to the Beanstalk protocol and received enough BEAN to basically push through any proposal. Here, the hacker proposed sending money to Ukraine via a wallet controlled by the hacker, voted the proposal through, and sent all the staked assets to the wallet. Then, the hacker repaid the flash loan and netted approximately $76M (via Beanstalk).

Since the attack, the Beanstalk protocol has been “paused” and is not operating. Members of the DAO have proposed a “Barn Raise” to restore 100% of the $76M lost. While there was $182M lost according to several news sources, Beanstalk is bizarrely using the hacker’s profit number likely to downplay the loss (via WSJ). They also plan to shift their DAO governance model and have a series of steps to unpause the protocol (via Beanstalk).

While we don’t condone the hacker’s attack, it’s important to note that the hacker did not do anything wrong/illegal according to the DAO rules (via WSJ). The Beanstalk protocol was used as it was written, and a logical hole was exploited for the hacker’s personal gain. With projects spinning up so quickly in the web3 sphere, it’s unsurprising that many are riddled with such logical disparities waiting to be leveraged. It’ll be interesting to see if the Beanstalk protocol can recover after such a dramatic loss. Remember Lindy.

Final Cup

Binance allegedly handed over their users’ data to Russian intelligence agency Rosfin. Lots of factors to consider before you formulate your own opinion on the matter.

Coinbase to join the NFT space through its NFT marketplace available to U.S. citizens in the coming weeks. In a vacuum, low transaction fees and Instagram-like features= bullish. Let us see if they can challenge sector-leading OpenSea.

Beanstalk lost $182M to a hacker after the DAO rules were exploited by using a flash loan to attain $1B worth of governance tokens and send the Beanstalk liquidity to the hacker’s wallet. Be wary when investing in new protocols.

Meme of the Week (via CryptoMemes)

Rough week.

Pat + Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing.