Bitcoin Records Highest Monthly Loss In 11 Years

Market Movers

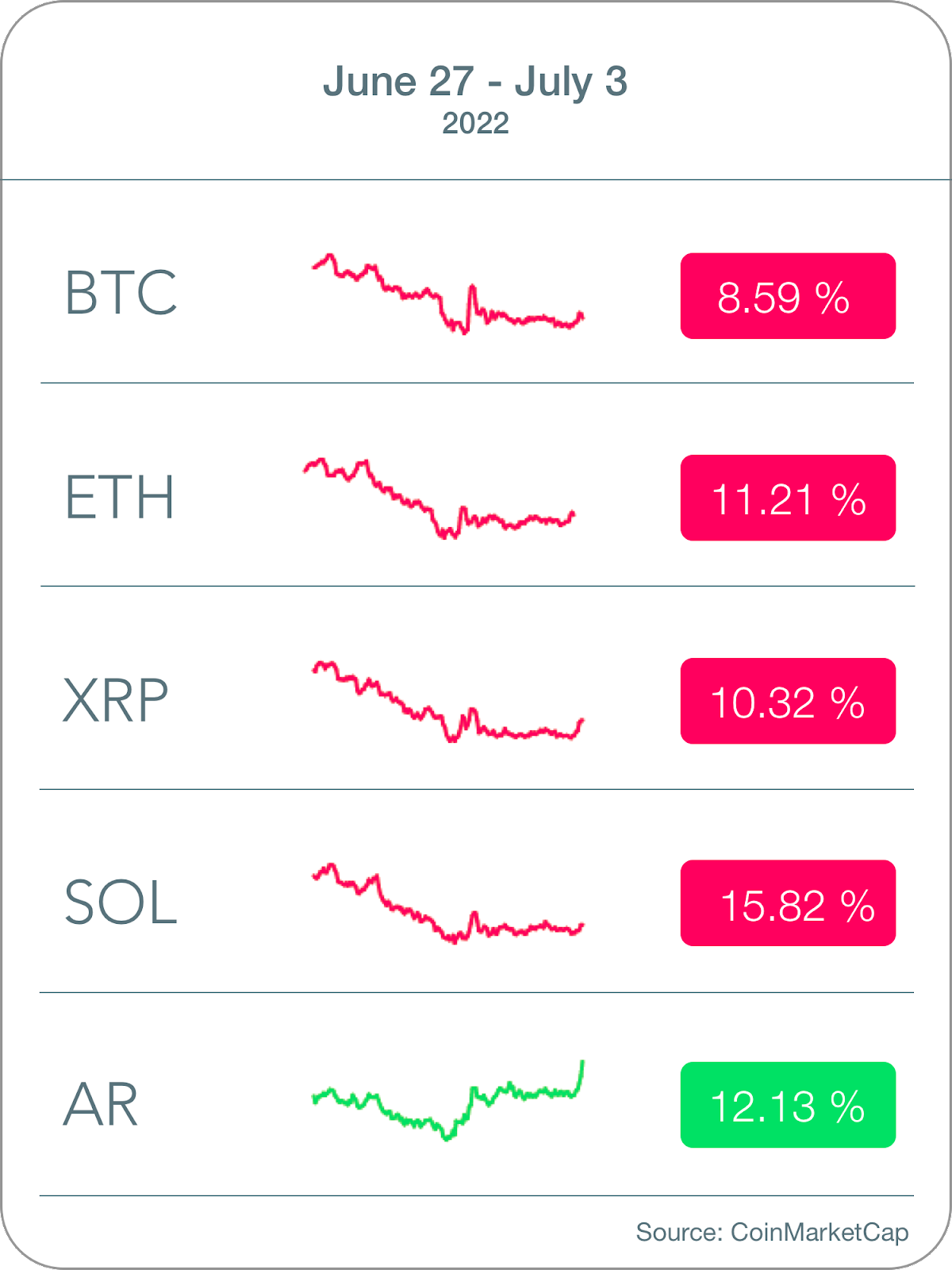

The largest coins by market cap were in the red for the week; headlined by Bitcoin dropping a little south of 9% and Ethereum falling just over 11%

Arweave (AR) was our pump coin of the week, rising just over 12%

AR is a decentralized storage network that pays miners in its native currency, AR, to secure the network

First Sip

If you’re already a crypto native, feel free to skip to “Table Talk.”

DOGECOIN PRIMER

Rounding out the top 10 coins by market cap (not including stablecoins), we have Dogecoin (DOGE). We’ve mentioned DOGE in past weeks when discussing meme coins in this section, and Dogecoin is arguably the most successful of the category.

Founded in 2013, DOGE was meant as a more accessible play on cryptocurrencies like Bitcoin with an element of satire.

Like Bitcoin, Dogecoin currently runs a Proof of Work (PoW) algorithm, but instead of looking to minimize the supply of coins, there are 10K Dogecoins mined every minute compared to less than one Bitcoin per minute. This mining process has kept the value of individual coins quite low <7 cents at the time of this writing but has also allowed Dogecoin to amass the market cap it has with a market cap of over $8B (via CoinMarketCap). As there are so many coins in circulation, a hefty demand increase is required to drive up the price of DOGE. Many of these price increases can be attributed to Elon Musk whose tweets about the cryptocurrency have caused demand to explode.

Dogecoin’s utility beyond a speculative experiment is minimal. It’s accepted as payment by a small set of vendors and has a bridge to cash-like utility through the BitPay card but it has had very little development since its creation (via BitPay). Holders of the asset have made massive gains in the past, but its long-term value is completely tied to its demand increasing; we’ll see if that holds.

Table Talk

BITCOIN RECORDS HIGHEST MONTHLY LOSS IN 11 YEARS

The newsletter content over the past couple weeks has been relatively consistent: decline in the overall public markets → investors respond by consolidating their capital into risk-off assets → decline in cryptocurrency prices.

This week is no different.

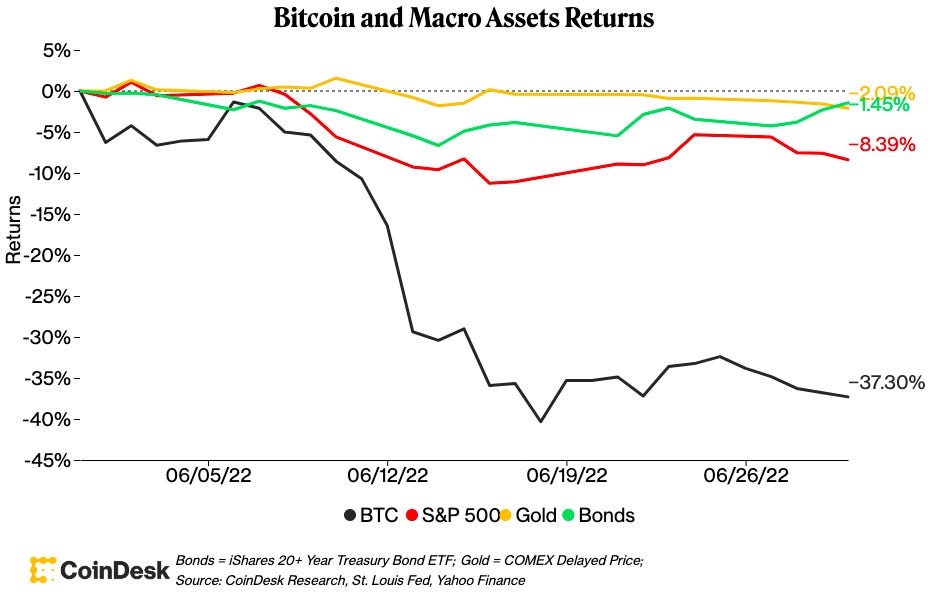

Bitcoin closed the month of June by dropping a total of 38%, its largest one-month value decline since 2011 (via CoinDesk).

40-year inflation, supply chain issues from the Russian/Ukraine War, Terra’s collapse, the liquidation of Three Arrows Capital, and Celsius Network freezing out investors can all be labeled as events that are contributing, and rightfully so, to investors selling their crypto in favor of more conservative assets.

You do not receive lofty returns on your crypto investments without extreme volatility.

With more risk, there’s the potential for high rewards and high losses. Continue to navigate this bear market accordingly.

NFT Buzz

NFT SALES HIT 12-MONTH LOW

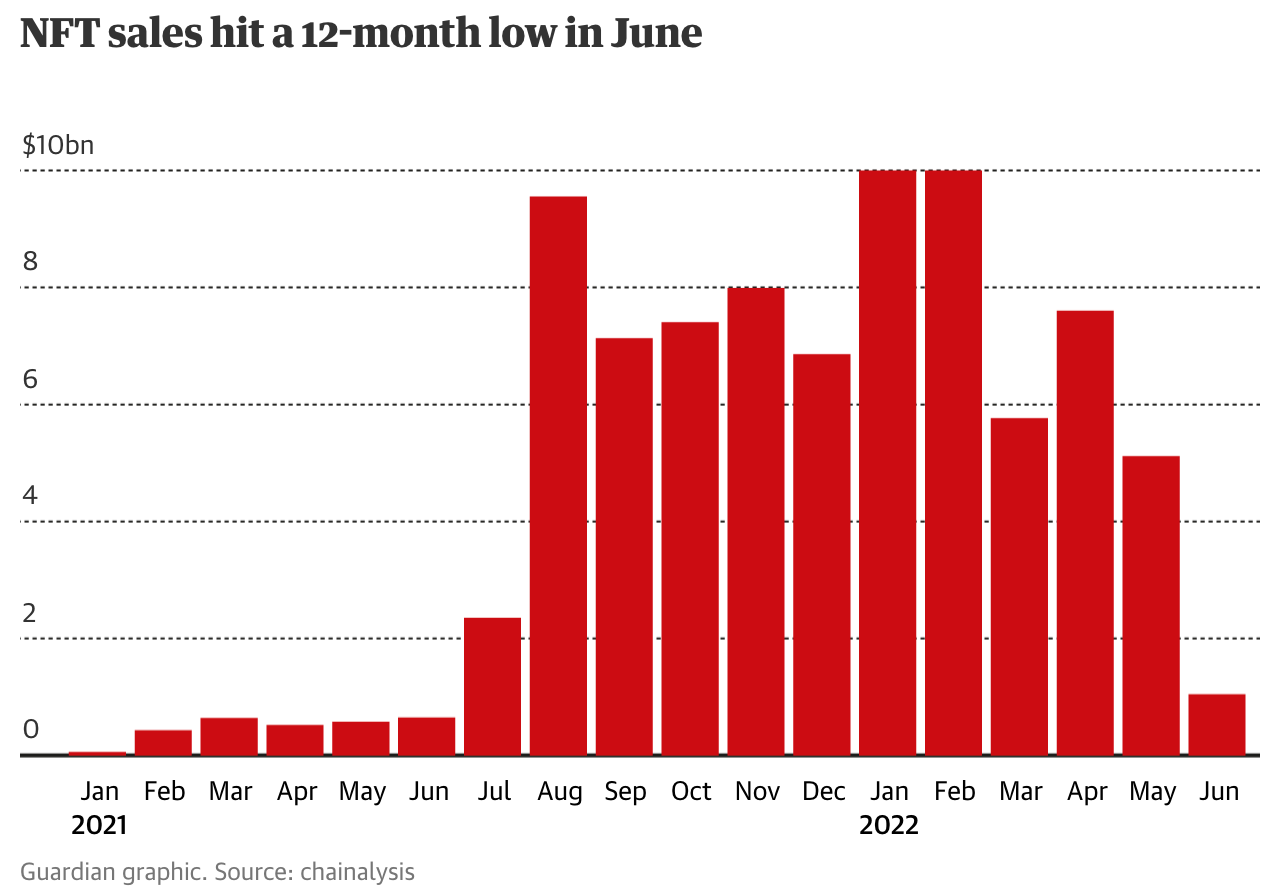

Total NFT sales amounted to over $1B in June. Although that number may seem large, it represents a one-year low for NFT sales.

For example, the non-fungible crypto sector peaked in January of this year as $12.6B worth of NFTs were transacted (via The Guardian).

Moral of the story: NFTs are facing the repercussions of the bear market just as much as the broader crypto market.

Although volume is low given the broader market conditions, the NFT industry is here to stay.

NFTs, like crypto, are deemed “high risk” assets by many investors.

$1B worth of sales in June, although a 12-month low, is no joke; NFTs are here to stay.

DeFi Demographic

VOYAGER SUSPENDS WITHDRAWALS

Following in the footsteps of the Celsius Network, the crypto-lender Voyager Digital suspended all withdrawals, deposits, and reward payments (via The Defiant). This freeze comes on the heels of lendee Three Arrows Capital’s default on a $658M loan. Voyager is using this as an opportunity to evaluate “strategic alternatives with various interested parties while preserving the value of the Voyager platform” per their CEO Stephen Ehrlich (via Fortune).

Sounds like Voyager Digital is looking for a buyer. We’ll see if anyone bites.

POLYGON AND FANTOM RPC GATEWAYS HIJACKED

Hackers orchestrated a Denial of Service (DNS) attack on Remote Protocol Call (RPC) sites supported by Ankr (via Twitter). Crypto, as we’ve seen through the many hacks, is very much a dark forest. The latest hack leveraged social engineering to convince the company that owned the certificate authority for the Polygon RPC and Fantom RPC websites that they should switch to another webpage controlled by the hacker (via The Defiant). The hacker then attempted to use this site to capture confidential crypto wallet information of users who logged into the site.

At the time of this writing, Ankr has released no information about how many users were affected but was able to successfully return the compromised sites to point to the correct webpages. Ankr says it has taken steps to mitigate this kind of attack in the future (via Twitter).

We’ll see what attacks next week brings and if protocols are up to the task of defending themselves. It’s the price of progress.

Final Cup

Bitcoin’s price dropped 38% in the month of June, its largest fall for a month since 2011

Total NFT sales hit one-year lows for the month of June, totaling $1B

Voyager suspended deposits and withdrawals while Ankr was subject to a social engineering hack: common themes for DeFi we’ve seen over the past several months. Stay cautious, especially during market turbulence.

Meme of the Week (via Reddit)

Hope everyone has a great 4th 🇺🇸

Pat + Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing.