Bitcoin ATMs: Technology of the Past?

Market Movers

The largest coins by market cap were in the green for the week, highlighted by Cardano (ADA) rising over 22%

Helium (HNT) was our biggest mover of the week, rising just south of 30%

HNT was established in 2019 and allows devices to send each other data wirelessly through their native blockchain (via CoinMarketCap)

First Sip

If you’re already a crypto native, feel free to skip to “Table Talk.”

A PRIMER ON CARDANO

After the Cardano (ADA) charge this week, we thought we’d do a shallow dive into the coin, its value add, and how it works. It’s notable that Cardano’s price moment comes after a Solana outage that caused significant capital to exit the project. Much of that capital seems to have been re-allocated from Solana to Cardano.

Cardano was founded by Charles Hoskinson, who also founded Ethereum, but decided to step away from the project. The coin’s anti-intuitive ticker, ADA, is a homage to the first programmer: Ada Lovelace.

In contrast to Ethereum, Cardano uses a Proof of Stake (PoS) consensus algorithm called Oroborus, making it much more environmentally friendly. It emphasizes peer-validated research to maximize scalability and security.

Ouroboros selects random staking nodes to validate transactions much like classical PoS and calls these nodes “slot leaders” (via eToro). The blockchain is then broken up into epochs, basically chunks, and these chunks are assigned to the slot leaders. A slot leader can verify the blockchain themselves or chunk it out further and allow other nodes to help by the splitting epoch further. All the nodes that help validate the blockchain are rewarded in proportion to the amount validated. This makes the blockchain incredibly scalable.

The ADA token can be staked individually or submitted to staking pools and gives holders the right to vote in Cardano governance, following the DAO model.

Also notably, Cardano also offers the Dadelaus wallet, which runs an entire blockchain node in the PoS system such that users of the wallet that holds ADA can be full owners of their cryptocurrency while also participating in the network. Other Cardano wallets like Yoroi allow you to avoid running the blockchain node and instead allow ADA holders to submit their ADA to a staking pool.

Table Talk

BITCOIN ATM INSTALLATIONS HIT 3-YEAR LOW

Quick market rundown before we talk about BTC ATMS

Bitcoin closed above $29,450 ($31K at the time of writing this) come Sunday night, which means it recorded its first weekly green candle since March. Although the green candle indicator is positive, Bitcoin continues to be stuck in a range of roughly $28K to $31K since early May, as CoinTelegraph’s chart depicts.

In other markets, the Nasdaq was down 2.3% for the week, whereas the S&P 500 shed 1.4 percentage points.

Now onto ATMs…

This past week, CoinTelegraph pointed out how new Bitcoin ATM installations reached 3-year lows in the month of May, with only 202 new machines being set up.

A Bitcoin ATM is what it seems to be; one can use cash or debit to purchase Bitcoin, which is then sent directly to one’s crypto wallet. Moreover, Bitcoin ATMs are either unidirectional machines, meaning they support either the buying or selling of Bitcoin or they are bi-directional machines, meaning they support both the buying and selling of Bitcoin. There are currently around 37K Bitcoin ATMs in the world, with roughly 88% of them being in the U.S. (via CoinTelegraph).

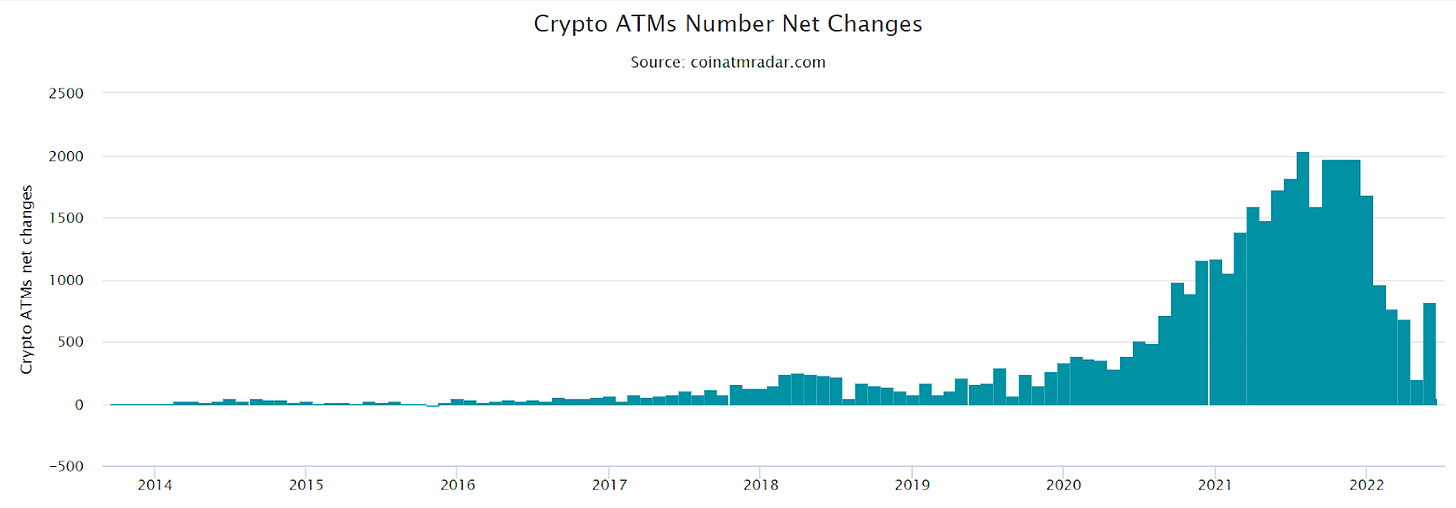

As Bitcoin/crypto has become more mainstream since the first BTC ATM was set up in the U.S. in 2014, the number of ATMs has also increased steadily. Coin ATM Radar highlights this upward trend in the graph below:

However, as you can see on the right side of the graph, this trend began to reverse over the last five months, ending with only 202 Bitcoin ATMs set up in May 2022, the lowest number of new machines since 2019. Surprisingly enough, 817 ATMs have already been set up in June.

Regardless of June’s reversal, the number of new BTC ATMs has been on a downtrend over the last five months. The trend is no surprise given Bitcoin’s overall negative price movement in the same time period, the stock market’s fall, global conflicts, and the aftershocks of COVID (amongst other things). It should be interesting to see how the number of new machines responds to BTC price movement over the next couple of months.

NFT Buzz

BAYC HACKED

Another week, another NFT heist.

This past Saturday, one of the Bored Ape Yacht Club’s (BAYC) discord manager Boris Vagner’s account was compromised, which led to approximately $260K in NFTs being stolen (via CoinDesk).

After gaining access to the account, the hacker sent out a phishing link in the BAYC and Otherside NFT discord channel pretending to host an “exclusive giveaway,” seen below, and was then easily able to hack the wallets of a few unsuspecting customers.

The company behind BAYC and Otherdeeds, Yuga Labs, is facing some justified scrutiny since the attack marks the company’s second security breach within the last two months; $2.5M worth of NFTs were stolen via their Instagram account in late April (via Engadget).

Although Yuga Labs must increase their security measures given the capital behind their company (they were valued at $4B in late March), one thing we cannot stress enough is to NEVER click on links that seem sketchy when on Discord, Twitter, Instagram or any social media account in general.

Although the recent hack was basically unavoidable, given the scammer was sending messages from one of the community managers’ official accounts, one should never click on any links that are messaged to you directly. Hackers love to create fake accounts mimicking project creators, buy Twitter followers to seem legit, and then message people who are new to the NFT space with phishing links. If you don’t believe how vital this talking point is, simply look at OkayBears’ cofounder’s official Twitter bio.

Additionally, as we have spoken about in previous newsletters, you can transfer your NFTs from a hot storage wallet to a cold storage wallet to eliminate any further security breaches.

DeFi Demographic

After weeks of being hammered, many different crypto projects are beginning to see lawsuits. For example, Pool Together, an early yield farming protocol that allows users to deposit into it in exchange for lottery rewards based on the staking gains, was recently hit by a lawsuit by ex-Elizabeth Warren presidential campaign technologist Joseph Kent who submitted $10 into the protocol. He then filed a suit that alleged that Pool Together was running an illegal lottery. New York State law then allowed him to file it as a class action suit on behalf of the ticket holders (via Crypto Briefing). So far, Pool Together has responded by raising an $800K plus war chest to fight the lawsuit (via Crypto Briefing).

While most lawsuits in the space are not as transparently opportunistic as Kent’s, it shows a building trend in the crypto space. Class action lawsuits are coming in droves from those who lost money on various projects with shaky fundamentals, intentional or otherwise (via WSJ). It’s reasonable to expect that this will trigger more regulatory involvement in the space in the U.S. and beyond. Unfortunately, or fortunately, depending on your views, we may finally see clear crypto regulation in the U.S. from this as Americans lose money and file suits in these projects.

Final Cup

Bitcoin ATM installations hit 3-year lows for the month of May. Additionally, Bitcoin is stuck in the $28k-$31K price range.

Hackers compromised a BAYC discord manager’s account to steal $260K worth in NFTs. Only open official links and beware of scammers.

Crypto lawsuits keep coming in as a response to the economic downturn. Expect the U.S. and other regulatory agencies to begin applying more security, litigation, and regulation.

Meme of the Week (via Piplum)

Pat & Ari ✌️

Disclaimer: None of this is investment advice, financial advice, or trading advice. CRYPTOPONG does not endorse any of the cryptocurrencies, DeFi applications, or NFT collections mentioned in this article. Perform your own due diligence and/or consult a financial advisor before investing.